On Tuesday, October 20th we sent out an email regarding CalSavers. We have received some questions in regards to the program so here are a few additional pieces of information:

- You may or may not have received your letter from the State of California. If you have not received your letter and need your access code you may go to calsavers.com and click the “Request access code” link. You will need your legal business name, EIN or TIN, and your CA Employer Payroll Tax Account Number (from EDD).

- If you are not currently enrolled in a pension plan, please contact our office before registering with CalSavers.

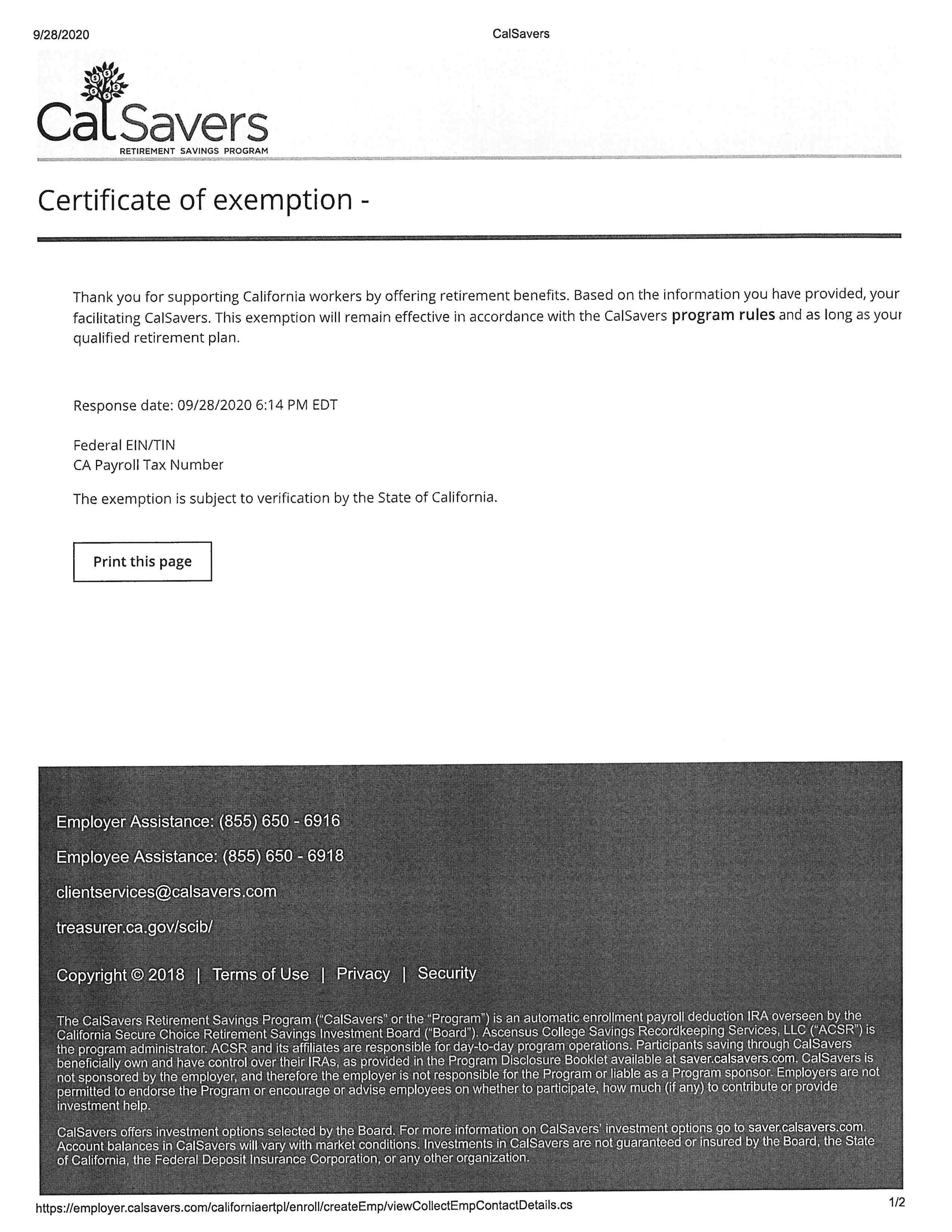

- When you certify your exemption please save your certificate (see example below). In the case that you receive a letter claiming you missed your deadline, the Certificate of Exemption serves as your proof.

- The deadline dates to certify your exemption are as follows:

- More than 100 employees: September 30, 2020

- More than 50 employees: June 30, 2021

- 5 or more employees: June 30, 2022

- If you have not registered or certified your exemption by the deadline dates above you may be subject to a penalty of up to $500 per eligible employee.

Please don’t hesitate to call our office with any questions.

|